Ever since the release of SKAN 4.0 in October 2022, there’s been a lot of buzz surrounding the changes it brings and how it will affect advertisers. To demystify SKAN 4.0, we’re discussing the shifts and offering some advice on how mobile marketers can adapt.

What is SKAN 4.0?

SKAN 4.0 is the newest installment of SKAdNetwork. Introduced by Apple in 2018, SKAdNetwork is an API that provides a privacy-first attribution method for iOS campaigns without revealing user data; at the same time, user-level tracking became an opt-in requirement (ATT) where previously it was opt-out.

From a marketer’s point of view, SKAN is used with two functions in mind:

- Measurement: understanding how campaigns are performing versus your goals

- Signals for ad networks: giving the right postbacks in a suitable distribution for channels (e.g Meta, TikTok) to optimise with

For the past few years, it’s been a balancing act between these two. Here at Miri, we see the most value in leaning on the latter for performance due to limitations on measurement and reporting. This is because you may not be able to get the right signals you need to predict revenue and profitability in the first 24h of activity based purely on SKAN data alone.

For many advertisers and teams we’re working with, taking ATT opt-in user data and extrapolating it based on the full install cohort is a popular way to estimate longer term campaign performance – it has its pros and cons, but allows us to then prioritise the SKAN Conversion Value schema to provide the right signals for the channels we’re spending on.

What are the major changes with SKAN 4.0?

Overall, SKAN 4.0 expands what is possible in terms of measurement for advertisers. We’ve always had visibility as to how different channels interpret which creatives are working well and which are not, but never had access to unmodelled creative data. We hope that SKAN 4.0 will possibly level the playing field for creative-level reporting and visibility.

Here are some of the major changes with 4.0:

1. LTV Measurement

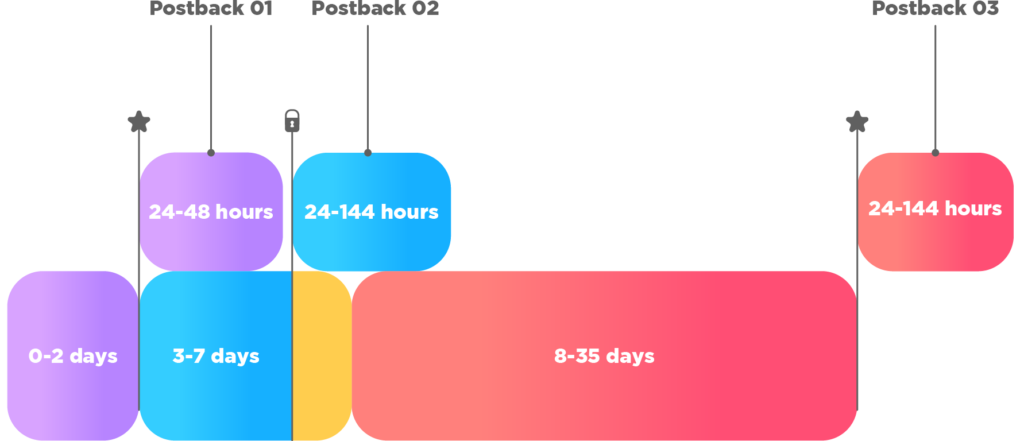

One of the much-anticipated aspects of SKAN 4.0 is the ability to measure post-install engagement through multiple postbacks. These postbacks are tied to time windows:

- 1st postback – measures up to 48 hours of user activity

- 2nd postback – measures activity for day 3 – 7

- 3rd postback – measures activity from day 8 – 35

The first postback will receive fine-grained conversion values (a 6-bit value allowing for up to 64 combinations – what we’re used to pre-4.0), while the second and third will receive coarse-grained values (one of three different values – low, medium, and high).

At Miri, the introduction of two new postbacks is particularly exciting since we’ve always seen the conversion value schema as a variable to experiment with. Testing new events in the schema or different size revenue buckets (or a combination of the two) has always been a core part of how we treat SKAN, instead of set-and-stay with what we may think is the “optimal” CV Schema.

An example of the 2nd and 3rd postback for a subscription-app business with a free trial would be:

- Low: Trial/Subscription Cancelled

- Medium: Trial Started

- High: Subscription Converted

2. Optimisation for channels and ad networks

SKAN 4.0 also presents finer granularity in campaign dimension reporting. Previously, campaign IDs were limited to 2 digits, but with SKAN 4.0, the campaign ID is reborn as a “source identifier” and can contain up to 4 digits.

We’re still subject to how different channels will choose to use source identifiers, but we can expect better creative-level reporting accuracy. In some cases, we’ve seen misleading signals in creative-level modelling and, given how critical creative performance is to drive overall UA performance, it’s important that we’re making decisions with accurate creative data.

If privacy thresholds are met, ad networks will now receive all 4 digits in a postback. It’s up to them to use the extra 2 digits for internal optimisation or additional reporting breakdown. Source ID gives marketers a better view of which campaigns are bringing quality users to their apps.

The Privacy Threshold has always been a key consideration and limitation in defining our paid social UA strategy on iOS. Now, adhering to it unlocks even more data – making it more impactful than ever before.

3. More attribution channels

Previous versions of SKAN had a lack of support for Web-to-App attribution, meaning some marketers’ main acquisition channels were not covered by SKAN. As an example, we’ve seen this impact some layers of Search and Display SKAN tracking on Google Ads.

SKAN 4.0 changes this by introducing Web-to-App attribution – but only for Safari. Nevertheless, this allows advertisers to understand how ads in Safari relate to in-app engagement. At Miri, we’re seeing an increase in adoption of Web-to-App campaigns in paid user acquisition as a funnel flow – whereby the users go from the creative to a landing page, which ultimately leads them to the App Store with an extra layer of context. This adds a new format for marketers to test different funnel approaches.

4. Privacy thresholds

Previously, if a group of users did not pass privacy thresholds, Apple dropped conversion value from the postback, becoming null. But with 4.0, there are now four tiers of crowd anonymity: 0, 1, 2, and 3. Apple figures out which crowd anonymity tier the install belongs to and might ditch one or more of the fields based on the tier.

Whilst the minimum install number to pass the privacy threshold is not explicitly defined by Apple, ad network testing can help us identify a recommended minimum per campaign, per day. This minimum is likely to change with the introduction of fine and coarse grain data levels, but also within that source identifier. Going forward, it will be about adapting to ensuring we have a good eye on what the level is that we need for every campaign and how we should consolidate scale and budgets with this information in mind.

How can mobile advertisers adjust?

There’s one thing that won’t change – and that’s the fact that we are still at the mercy of how these SRNs will choose to use SKAN and how they choose to interpret the data. A single advertiser won’t be able to change the SKAN framework or how it’s interpreted.

It may take a while to fully understand the weight of SKAN 4.0 – and ultimately, SRNs and publishers are the ones to have the final say. This is evident in the fact that SKAN 4.0 was released in October 2022 and SRNs are still yet to adopt this in a global launch for advertisers. Even so, we expect that SKAN 4.0 will provide advertisers with better visibility of user behaviour, along with a more transparent, accurate way to gauge the effectiveness of their campaigns.

Empowered with more feedback, we hope that we can have more confidence in identifying the best channels and campaigns that are driving overall performance. This will help us to have more confidence in iOS within the overall UA strategy.

Stay up to date with Miri Growth

In our eyes, the most important thing is to maintain an open mind and continually experiment with this new framework to see how it can work for you. Our thoughts and insight on the impact of SKAN 4.0 are subject to change as time goes on – so be sure to keep up with our blog for new updates.

Miri Growth is a performance marketing and creative agency working with Paid Social channels (Meta, Google, TikTok, Snapchat) and DSPs. We offer comprehensive mobile marketing services – from fully managed User Acquisition to Creative Strategy and Production – helping your app or game to scale. Learn more about our services by getting in touch today.