The loss of IDFA is nothing new for mobile marketers, but it continues to impact current and future mobile growth strategies. Across our portfolio of mobile app clients, around 70% of the performance budget targets iOS users. This audience remains highly valuable, but reaching the right people has become more challenging.

The Identifier for Advertisers (IDFA) once fueled mobile app performance advertising, enabling precise targeting and measurement for networks and advertisers alike. When Apple introduced App Tracking Transparency (ATT) in iOS 14.5 back in April 2021, user privacy took center stage. Users are now automatically opted out of IDFA tracking, and advertisers have to ask permission for each app, significantly limiting its effectiveness. This article explores the impact of IDFA’s decline, the challenges and opportunities it presents, the upcoming successor to SKAN (AdAttributionKit), and the evolving landscape of mobile app advertising in a privacy-centric future.

The Pre-ATT Era: A Look Back

Before ATT, IDFA facilitated a data-driven approach to mobile app performance marketing. Advertisers could leverage user data from various sources, including app usage history, demographics, and interests, to target specific user segments with highly relevant ads. This targeted approach maximized campaign efficiency and effectiveness, benefiting both advertisers and networks.

Networks benefitted from high volumes of valuable user-conversion data (postbacks and pixels) to fuel their algorithms, enabling advertisers to reach highly targeted audiences, resulting in increased conversion rates, click-through rates, and overall return on ad spend (ROI). However, this data-driven approach also raised privacy concerns. Users were often unaware of the extent to which their data was being collected and shared, leading to concerns about data misuse and a lack of user control.

IDFA's Fallout: A SKAN Reality

Since iOS 14.5, advertisers have had to juggle multiple attribution methodologies and rebuild user acquisition strategies from scratch. The limitations on IDFA have fundamentally changed the mobile app advertising landscape, specifically:

- Reduced Targeting Accuracy: across our portfolio of apps, ATT opt-in rates average between 20-40%. With SKAN postbacks being aggregated and anonymized, networks have less information on their iOS traffic and must rely more on contextual targeting.

- Network Attribution Inconsistencies: Different networks have adopted various attribution methodologies—Meta uses AEM, Google relies on Firebase, and ad networks still utilize probabilistic attribution (though its longevity is uncertain). This adds additional knowledge requirements and implementation time for advertisers.

- Advertiser Measurement Meltdown: Attribution of creative/campaign/network success has become challenging. Advertisers have limited and noisy visibility into which networks and creatives drive conversions, hindering campaign optimization and making it difficult to measure ROI accurately.

The decline of IDFA also impacts app developers and the broader mobile advertising ecosystem:

- Impact on Smaller Developers: Smaller budgets lead to a lower volume of data and ultimately more noise on campaign performance. Smaller app developers who relied heavily on third-party data for user acquisition may struggle to compete with larger players with robust first-party data strategies.

- In-App Advertising Revenue: The mobile games industry, particularly Hypercasual Games, thrived with in-app advertising revenue. IDFA limitations have led to a significant drop in the effectiveness of IAA monetization strategies, causing a pivot into hybrid IAA & IAP and IAP-only strategies.

Navigating the New Landscape

While there are challenges, IDFA’s decline also presents opportunities for innovation and a more privacy-focused future for mobile app advertising. We manage significant budgets across paid-social campaigns and networks that operate as Self-Attributing Networks (SANs). These networks don’t allow for probabilistic attribution via MMPs, so we optimize the SKAN Conversion-Value setup and extrapolate with user opt-in data. We see the SKAN conversion value schema as a lever for performance:

- Balancing the right signals for ad networks to optimize with

- VS Having the right signals for us as advertisers to make optimization decisions

We’ve tested SKAN 4.0 CV Schemas across various app genres, specifically finding that:

- A 6-bit schema tends to be best for Subscription Apps

- Revenue Buckets tend to be best for high-frequency IAP & IAA games

- Blended is the best all-rounder

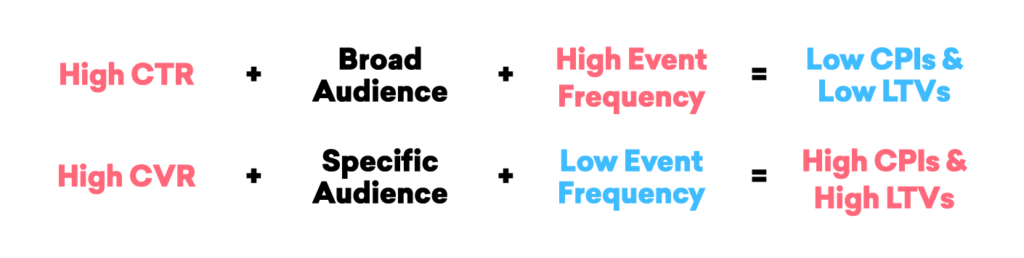

Given various privacy thresholds, a popular solution for finding the right event postbacks is experimenting with proxy event optimization—identifying key funnel events with a balance of event value and event frequency. The success cases we’ve seen effectively balance the two following equations to achieve a scalable ROI.

The Role of Creative in User Acquisition

A significant driver of user acquisition performance is in the creative and the balance of CTR and CVR. Now, more than ever, creative impacts who you reach (effectively your targeting), how much you pay to reach them (more engaging ads drive lower CPMs), and ultimately your ROI (creative can impact your in-app conversion rates). With user-level data becoming more restricted, contextual targeting has become more important. However, this comes with its pros and cons:

- Creative is Key: Ad creatives fight to be more contextually relevant. Consider the app environment, user behavior within the app, and content relevance to resonate with users. Interactive ad formats, native advertising that blends seamlessly with app content, and short, engaging video ads are promising areas to explore.

- But Creative-Level Data is Unreliable: Across SANs, creative-level data is often estimated and must be taken with a pinch of salt—relying on CTRs, CPCs, or simple ad-spend share each have their limitations. For apps at scale, letting networks like Meta effectively “choose” the winner can sometimes end unfavorably; we’ve seen multiple occasions where an ad can quickly scale to become a top-spender but deliver unsatisfactory results.

AdAttributionKit: SKAN’s Successor

AdAttributionKit was announced at Apple’s WWDC 2024, and it is expected that AdAttributionKit will eventually replace SKAN. For mobile app advertisers, the highlights of the announcement include:

- Support for Alternative App Stores

- AdAttributionKit will run in parallel with SKAN; will SKAN be deprecated?

- Allows for retargeting; SKAN missing retargeting was a large oversight

- Introduces multi-touch attribution; this will be very interesting to analyze cross-channel incrementality

Closing Thoughts

The limitations on IDFA have undoubtedly ushered in a new era for mobile app advertising, compelling advertisers to adapt swiftly to a privacy-centric landscape. This shift has led to several key challenges: reduced targeting accuracy, inconsistencies in network attribution, and difficulties in measuring campaign effectiveness. However, it has also opened avenues for innovation and strategic refinement and forced advertisers to continually question their assumptions and find new ways to stand out in an ever-competitive market.

Ultimately, app growth fundamentals remain unchanged: a compelling product, innovative creatives, and a balanced user acquisition strategy – the perfect blend will be what drives success.